- Carve-outs

- Control buyouts

- Corporate partnerships

- Family partnerships

- Growth equity

Our investments take a variety of forms. We acquire non-core corporate divisions and family enterprises transitioning to new ownership, as well as businesses from other private and public owners. Often, we craft partnerships with sellers who retain significant ongoing ownership and share in future value creation alongside CD&R.

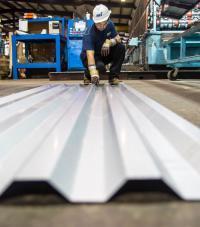

The industries we target for investment are business services, consumer/retail, financial services, healthcare, industrials, and technology. Our companies range in size from regional sector champions to global industry leaders and typically share several key attributes:

- Leading sustainable market positions in industries poised for long-term growth;

- Competitive advantages through differentiated products, technology/business services, or processes;

- Potential to improve growth and enhance productivity;

- Broad “spread of risk” characteristics, such as multiple locations, wide-ranging customer and supplier bases, and diverse revenue streams;

- Attractive return on capital characteristics; and

- Stable cash flows.